All Categories

Featured

Table of Contents

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. top-rated life insurance companies from brokers. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

That generally makes them an extra budget-friendly choice permanently insurance policy coverage. Some term policies might not keep the premium and survivor benefit the exact same in time. You do not intend to erroneously believe you're buying degree term coverage and after that have your survivor benefit change later. Lots of people obtain life insurance policy protection to help financially protect their loved ones in case of their unforeseen fatality.

Or you may have the choice to transform your existing term insurance coverage right into an irreversible policy that lasts the remainder of your life. Various life insurance policy plans have possible advantages and downsides, so it is very important to understand each prior to you make a decision to purchase a plan. There are a number of benefits of term life insurance policy, making it a preferred choice for protection.

As long as you pay the premium, your beneficiaries will receive the survivor benefit if you die while covered. That stated, it is necessary to note that most policies are contestable for two years which implies protection might be retracted on fatality, should a misstatement be located in the app. Policies that are not contestable usually have actually a rated fatality benefit.

Costs are typically less than entire life policies. With a degree term plan, you can choose your protection amount and the plan size. You're not locked into an agreement for the rest of your life. Throughout your policy, you never have to stress regarding the premium or death benefit quantities altering.

And you can not pay out your plan throughout its term, so you won't receive any economic gain from your past coverage. Just like other sorts of life insurance policy, the cost of a degree term policy depends upon your age, protection needs, employment, way of living and health. Generally, you'll discover a lot more affordable protection if you're younger, healthier and less dangerous to insure.

Reputable Decreasing Term Life Insurance

Because degree term premiums stay the very same for the period of protection, you'll recognize specifically just how much you'll pay each time. Degree term insurance coverage additionally has some adaptability, enabling you to tailor your plan with added features.

You might have to satisfy certain problems and qualifications for your insurer to establish this biker. There also might be an age or time limit on the protection.

The survivor benefit is typically smaller sized, and protection generally lasts up until your child transforms 18 or 25. This cyclist may be an extra cost-effective way to assist ensure your youngsters are covered as bikers can commonly cover numerous dependents at as soon as. When your child ages out of this coverage, it might be feasible to transform the cyclist right into a brand-new policy.

When comparing term versus permanent life insurance policy. guaranteed issue term life insurance, it's important to bear in mind there are a few different types. One of the most usual type of long-term life insurance coverage is entire life insurance, however it has some vital distinctions compared to degree term coverage. Here's a fundamental introduction of what to take into consideration when comparing term vs.

Whole life insurance policy lasts for life, while term insurance coverage lasts for a details duration. The premiums for term life insurance policy are typically less than whole life protection. With both, the premiums remain the exact same for the period of the plan. Whole life insurance policy has a cash value part, where a part of the costs might expand tax-deferred for future needs.

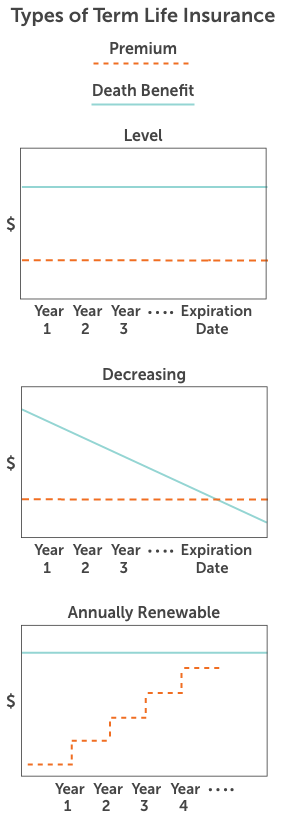

One of the main attributes of degree term protection is that your premiums and your fatality advantage don't alter. You might have coverage that starts with a death benefit of $10,000, which might cover a mortgage, and after that each year, the fatality benefit will lower by a set amount or portion.

Due to this, it's frequently a more budget friendly sort of level term protection. You may have life insurance policy with your employer, yet it might not suffice life insurance policy for your demands. The first step when getting a policy is identifying just how much life insurance policy you need. Consider variables such as: Age Family dimension and ages Employment standing Revenue Financial debt Way of living Expected last costs A life insurance coverage calculator can help determine just how much you require to start.

After choosing on a policy, complete the application. For the underwriting process, you might need to offer general personal, health and wellness, way of living and employment information. Your insurance provider will figure out if you are insurable and the danger you might present to them, which is reflected in your premium prices. If you're accepted, authorize the documentation and pay your initial costs.

Outstanding Joint Term Life Insurance

You might want to update your beneficiary info if you have actually had any kind of significant life modifications, such as a marital relationship, birth or separation. Life insurance policy can often feel complex.

No, degree term life insurance policy doesn't have money value. Some life insurance policy policies have an investment function that allows you to build cash money worth in time. A portion of your premium repayments is reserved and can gain rate of interest in time, which grows tax-deferred throughout the life of your protection.

These plans are commonly significantly extra costly than term coverage. If you get to the end of your plan and are still active, the coverage ends. However, you have some choices if you still desire some life insurance policy coverage. You can: If you're 65 and your coverage has actually gone out, for example, you may want to buy a new 10-year level term life insurance policy plan.

Sought-After Guaranteed Issue Term Life Insurance

You might be able to convert your term protection right into a whole life policy that will last for the rest of your life. Many kinds of degree term policies are exchangeable. That indicates, at the end of your protection, you can transform some or all of your policy to whole life coverage.

Degree term life insurance policy is a policy that lasts a set term usually in between 10 and thirty years and comes with a degree survivor benefit and level premiums that stay the exact same for the entire time the plan is in result. This means you'll recognize specifically how much your repayments are and when you'll need to make them, enabling you to budget plan appropriately.

Level term can be a great alternative if you're looking to acquire life insurance protection for the very first time. According to LIMRA's 2023 Insurance coverage Barometer Research Study, 30% of all grownups in the United state need life insurance coverage and don't have any type of type of policy. Degree term life is foreseeable and affordable, that makes it among one of the most prominent kinds of life insurance.

Latest Posts

Starting A Funeral Insurance Company

50 Plus Funeral Plans

Guarantee Trust Life Final Expense