All Categories

Featured

Table of Contents

Plans can likewise last till specified ages, which in most instances are 65. Beyond this surface-level details, having a greater understanding of what these plans involve will certainly assist ensure you purchase a plan that meets your demands.

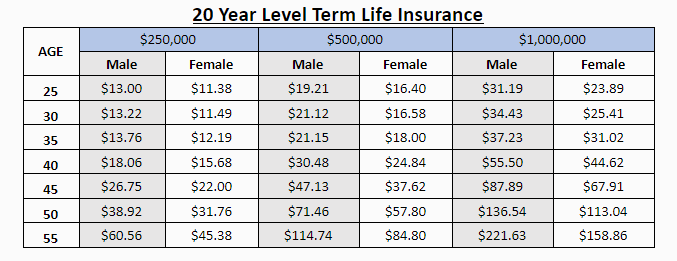

Be mindful that the term you pick will influence the premiums you spend for the plan. A 10-year level term life insurance policy policy will cost less than a 30-year policy since there's much less chance of an event while the strategy is energetic. Reduced danger for the insurance company relates to decrease premiums for the insurance holder.

Your family members's age need to also influence your policy term option. If you have little ones, a longer term makes good sense since it secures them for a longer time. Nonetheless, if your youngsters are near their adult years and will be financially independent in the future, a much shorter term might be a much better suitable for you than a lengthy one.

However, when comparing whole life insurance policy vs. term life insurance, it deserves noting that the last usually costs less than the previous. The outcome is much more protection with lower costs, giving the very best of both worlds if you require a significant amount of insurance coverage but can not pay for a more expensive plan.

What Does Level Term Life Insurance Policy Mean for You?

A degree fatality benefit for a term plan typically pays out as a swelling sum. Some level term life insurance coverage firms enable fixed-period repayments.

Passion payments got from life insurance policy policies are taken into consideration earnings and are subject to taxes. When your level term life policy runs out, a few various points can take place. Some coverage terminates quickly without choice for renewal. In various other situations, you can pay to extend the strategy beyond its original day or convert it right into a permanent policy.

The downside is that your sustainable degree term life insurance coverage will certainly come with greater premiums after its initial expiration. Advertisements by Cash. We may be made up if you click this advertisement. Ad For beginners, life insurance coverage can be made complex and you'll have questions you want responded to before dedicating to any type of policy.

Life insurance coverage companies have a formula for calculating danger making use of mortality and passion (What is level term life insurance). Insurance companies have hundreds of clients taking out term life plans at once and make use of the costs from its active plans to pay making it through beneficiaries of other policies. These firms use mortality to estimate the number of people within a specific group will file fatality cases annually, which details is used to determine typical life span for prospective insurance policy holders

In addition, insurance policy business can invest the money they obtain from costs and boost their income. The insurance policy firm can spend the cash and earn returns.

The list below section details the advantages and disadvantages of level term life insurance. Predictable premiums and life insurance policy protection Simplified policy structure Possible for conversion to permanent life insurance policy Restricted coverage period No cash worth accumulation Life insurance policy costs can boost after the term You'll discover clear advantages when contrasting degree term life insurance policy to other insurance types.

Understanding the Benefits of Guaranteed Level Term Life Insurance

From the minute you take out a policy, your costs will certainly never change, assisting you plan economically. Your coverage won't vary either, making these plans effective for estate planning.

If you go this path, your premiums will certainly increase but it's always great to have some versatility if you desire to maintain an active life insurance policy policy. Eco-friendly degree term life insurance coverage is an additional option worth considering. These plans permit you to maintain your current strategy after expiration, giving flexibility in the future.

How Does 10-year Level Term Life Insurance Compare to Other Types?

Unlike a entire life insurance policy plan, level term coverage does not last forever. You'll pick an insurance coverage term with the very best level term life insurance policy prices, yet you'll no more have insurance coverage once the plan runs out. This drawback could leave you rushing to find a new life insurance coverage plan in your later years, or paying a costs to expand your existing one.

Several whole, global and variable life insurance policy plans have a money value part. With among those plans, the insurance firm transfers a portion of your regular monthly costs payments right into a money worth account. This account gains passion or is invested, aiding it grow and offer a more considerable payment for your recipients.

With a level term life insurance policy plan, this is not the instance as there is no cash value part. Therefore, your policy won't expand, and your survivor benefit will never increase, consequently limiting the payout your beneficiaries will receive. If you desire a policy that offers a survivor benefit and develops cash value, consider whole, global or variable plans.

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. flexible universal life insurance policies from brokers. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

The 2nd your plan runs out, you'll no longer have life insurance coverage. Degree term and reducing life insurance deal comparable plans, with the major distinction being the death advantage.

It's a kind of cover you have for a certain quantity of time, called term life insurance. If you were to die while you're covered for (the term), your liked ones receive a set payout concurred when you get the policy. You just select the term and the cover quantity which you can base, as an example, on the expense of elevating youngsters up until they leave home and you might utilize the payment towards: Helping to repay your home loan, debts, charge card or car loans Assisting to pay for your funeral prices Aiding to pay university fees or wedding celebration expenses for your youngsters Helping to pay living prices, replacing your revenue.

What is Level Term Vs Decreasing Term Life Insurance? Key Considerations?

The plan has no cash money value so if your payments stop, so does your cover. If you take out a level term life insurance plan you could: Choose a repaired quantity of 250,000 over a 25-year term.

Latest Posts

Starting A Funeral Insurance Company

50 Plus Funeral Plans

Guarantee Trust Life Final Expense