All Categories

Featured

Table of Contents

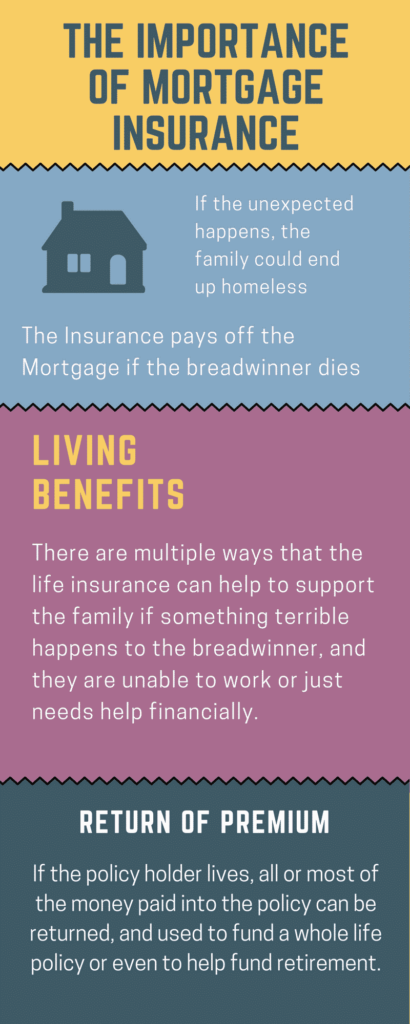

Life insurance coverage aids make certain that the monetary debt you owe toward your home can be paid if something takes place to you. It makes feeling to have a policy in area making certain that your family members will be able to keep their home no issue what lies in advance.

In some situations, a combination of coverage types may supply even more advantages than a solitary product service, much better safeguarding your home in the event that you die all of a sudden. The equilibrium owed on your home mortgage would certainly always be covered by the mix of one or numerous life insurance policy policies. mortgage protection insurance uk. Utilizing life insurance policy for home mortgage protection can reduce the threat of somebody being entrusted an unrestrainable monetary worry

Customizing your insurance coverage can give temporary security when your home mortgage amount is greatest and long-term defense to cover the entire period of the home mortgage. The mix method can function within your spending plan, supplies versatility and can be made to cover all mortgage repayments. There are numerous methods to utilize life insurance policy to aid cover your home loan, whether with a combination of plans or a solitary plan customized to your needs.

This policy lasts for the complete regard to your home mortgage (three decades). In case of your death, your family can use the death advantage to either pay off the mortgage or make continued mortgage payments. You buy an entire life insurance policy policy to provide long-term insurance coverage that fits your economic circumstance.

When it concerns shielding your loved ones and making sure the financial protection of your home, understanding home loan life insurance policy is necessary - insurance for mortgages. Home loan life insurance policy is a specialized kind of coverage made to repay mortgage debts and associated costs in case of the borrower's death. Allow's explore the types of mortgage life insurance policy available and the benefits they supply

This kind of insurance coverage is frequently used combined with a standard mortgage. The size of the policy lowers with time in accordance with the impressive balance of the home mortgage. As home loan repayments are made, the survivor benefit reduces to refer the new amortized home mortgage equilibrium exceptional. Lowering term insurance coverage makes certain that the payout lines up with the staying home loan financial debt.

House Life Insurance Mortgage

Unlike decreasing term insurance, the size of the policy does not decrease in time. The policy gives a fixed survivor benefit that remains the very same throughout the term, no matter the exceptional home mortgage balance. This type of insurance policy is fit for debtors who have interest-only home loans and wish to guarantee the full home mortgage amount is covered in the event of their death.

, several aspects come right into play. State and federal laws play a considerable function in determining what happens to the home and the home mortgage when the proprietor passes away.

These laws dictate the process and choices available to the successors and beneficiaries. It is essential to understand the details regulations in your jurisdiction to browse the situation effectively. If you have named a beneficiary for your home in your will, that person typically does not have to take over your mortgage, offered they are not co-borrowers or co-signers on the financing.

Mortgage Life Insurance Policy

The choice eventually rests with the heir.It's essential to think about the financial ramifications for your heirs and beneficiaries. If the thought heir falls short to make home mortgage payments, the lender maintains the right to confiscate. It may be needed to make certain that the successor can manage not just the home mortgage settlements however additionally the recurring costs such as home tax obligations, homeowners insurance policy, and upkeep.

In a lot of scenarios, a joint customer is additionally a joint owner and will become the sole owner of the property (best mortgage protection insurance uk). This implies they will think both the possession and the home loan commitments. It is very important to note that unless someone is a co-signer or a co-borrower on the finance, nobody is legally obliged to continue paying off the mortgage after the customer's fatality

If no one presumes the home loan, the home loan servicer may initiate foreclosure proceedings. Understanding the state and federal regulations, the effect on heirs and recipients, and the obligations of co-borrowers is crucial when it concerns browsing the intricate globe of mortgages after the fatality of the customer. Looking for legal guidance and thinking about estate planning choices can assist ensure a smoother change and secure the interests of all celebrations involved.

Can You Buy Mortgage Insurance

In this area, we will certainly check out the subjects of inheritance and home mortgage transfer, reverse mortgages after death, and the role of the enduring spouse. When it involves inheriting a home with an exceptional mortgage, a number of factors enter play. If your will names a successor to your home that is not a co-borrower or co-signer on the lending, they typically will not need to take control of the home mortgage.

In situations where there is no will or the successor is not named in the will, the obligation falls to the administrator of the estate. The administrator must continue making home loan settlements utilizing funds from the estate while the home's fate is being determined. If the estate does not have sufficient funds or assets, it may require to be liquidated to pay off the mortgage, which can develop problems for the heirs.

When one customer on a joint home loan dies, the enduring partner generally ends up being totally in charge of the home mortgage. Most of the times, a joint consumer is likewise a joint owner, which implies the surviving partner comes to be the single proprietor of the residential or commercial property. If the home loan was looked for with a co-borrower or co-signer, the various other celebration is legitimately bound to proceed making car loan repayments.

It is important for the making it through spouse to communicate with the lender, understand their rights and responsibilities, and discover available alternatives to make sure the smooth extension of the home loan or make essential plans if required. Recognizing what happens to a mortgage after the death of the property owner is vital for both the beneficiaries and the enduring spouse.

, mortgage defense insurance coverage (MPI) can supply valuable protection. Let's discover the coverage and benefits of home mortgage defense insurance coverage, as well as essential considerations for enrollment.

In the event of your death, the survivor benefit is paid directly to the mortgage lender, making sure that the outstanding funding equilibrium is covered. This permits your family members to stay in the home without the added anxiety of possible monetary difficulty. One of the benefits of home loan defense insurance policy is that it can be an alternative for individuals with extreme health troubles that may not certify for standard term life insurance policy.

Types Of Mortgage Insurance

Signing up in home mortgage defense insurance coverage needs mindful factor to consider. It is essential to examine the terms of the plan, consisting of the protection quantity, costs repayments, and any kind of exclusions or limitations. To acquire home mortgage protection insurance, usually, you require to sign up within a couple of years of closing on your home. This makes certain that you have insurance coverage in location if the unforeseen happens.

By recognizing the coverage and advantages of mortgage security insurance coverage, in addition to carefully reviewing your alternatives, you can make informed choices to shield your family members's financial wellness also in your lack. When it concerns handling home mortgages in Canada after the fatality of a homeowner, there are specific laws and regulations that come right into play.

In Canada, if the departed is the sole owner of the home, it comes to be a property that the Estate Trustee named in the individual's Will must manage (critical illness and mortgage cover). The Estate Trustee will certainly need to prepare the home to buy and use the proceeds to pay off the staying home loan. This is required for a discharge of the property owner's funding agreement to be registered

Latest Posts

Starting A Funeral Insurance Company

50 Plus Funeral Plans

Guarantee Trust Life Final Expense